We’re making some changes…

From April 2025, rents for most of our customers will increase by 2.7%. Our rents are set within a limit set by government which allows for increases of inflation plus 1%.

We are increasing rents by 2.7% because we feel this strikes the right balance between the need to protect customers from rising costs, and the need to maintain services and invest in improvements to homes.

Please take a look at the following Frequently Asked Questions, which we hope will answer any questions you may have. If you have any other questions please get in touch.

If you’re worried about the cost of living we are here to help. Our Money Advice Team can provide free, confidential advice around managing your money, household budgets and additional support you might be entitled to.

If you think you will struggle to pay your rent, please let us know as soon as you can. You can get in touch with a member of the team by calling 0300 555 0600 or by emailing moneyadviceteam@onward.co.uk.

Frequently asked questions

Why has my rent increased?

Our rent increases are set within a limit that is set by the Government called the Government Rent Standard. Under this, rents can be increased by inflation (Consumer Price Index) plus 1%. CPI is a measure of inflation that reflects changes in the cost of living.

Rental income helps housing associations to balance the needs of their customers and maintain properties against the economic environment they operate within.

How is the rent increase calculated?

Rents are set each year based on the Consumer Price Index figure in September, which was 1.7% in September 2024, plus 1%. Based on this, rents will increase by 2.7% for social, extra care and older persons properties, in line with the Government Rent Standard.

We have reached the decision to increase rents because it means that we can continue to invest in customers’ homes, our neighbourhoods and in improvements to our services. We believe in particular there is more investment needed to improve the standard of homes for the long term. We do recognise that the cost of living is a challenge and are here to help customers that might need extra support.

When will rents go up?

Rents will change from 1st April 2025 for monthly, quarterly, and annual charge accounts. Weekly rents will change from Monday 7th April.

I claim Universal Credit. Do I need to do anything?

Once you’ve received the letter confirming your rent charges in February, you will need to inform the Department for Work and Pensions (DWP) of this via their online portal after the rent increase has been applied. You can do this here.

It is important that you don’t do this until your rent has actually changed to make sure there are no issues with receiving your benefits, so you should do this on the day of or the days following your rent changing. If you do not manage your Universal Credit by the online portal, then you will need to contact the DWP by phoning the helpline on 0800 328 5644.

For support doing this contact our Money Advice team by calling 0300 555 0600 or emailing moneyadviceteam@onward.co.uk.

I claim Housing Benefit. Do I need to do anything?

If your Housing Benefit is paid directly to you, then you will need to inform Housing Benefit of your rent before 1st April 2025 to make sure you receive the correct payments. To do this you will need to contact your Local Authority and ask to speak to the Housing Benefit department. If your Housing Benefit is paid directly to Onward, you do not need to take any action. Onward will inform Housing Benefit of your new rent.

What do I do if I can’t afford the increase?

If you think you will struggle to pay your rent, please let us know as soon as you can. Our Money Advice Team is here to help.

If you are in receipt of Universal Credit allowance or Housing Benefit and this isn’t enough to cover the additional rent increase, we can advise on the options that are available. You can get in touch with a member of the team by calling 0300 555 0600 or by emailing moneyadviceteam@onward.co.uk.

Do I have to change my Direct Debit mandate or Standing Order?

Your Direct Debit will be adjusted automatically by our Customer Accounts Team – you don’t have to do anything. We may increase your Direct Debit by an additional amount on top of your usual payments if you are not paying fully in advance.

However, if you make rent payments by Standing Order you will need to contact your bank to amend the amount before 1st April 2025.

What if I am affected by the under-occupancy charge?

You will need to make sure that your payments cover your benefit shortfall. You may find that your payments need to increase to avoid falling into arrears. If you have any questions, please speak to our Money Advice Team.

How is the money from rents spent?

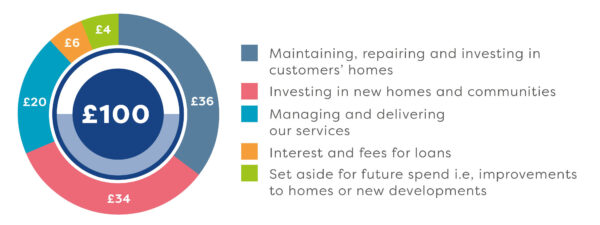

Income from rents means that we can continue to manage and improve our customers’ homes and invest back into our neighbourhoods. In the last twelve months, for every £100 of rental income we have spent:

If you are a Leaseholder or Shared Owner, please click on the button below for information and advice on your rent and service charges for 2025/26.